Introduction

Investing in mutual funds and exchange-traded funds (ETFs) has become a cornerstone of modern portfolio management. These investment vehicles offer diversification, professional management, and the potential for growth, making them an excellent choice for investors at all experience levels. This guide provides practical tips and strategies to help you make informed decisions and optimize your portfolio.

Understanding Mutual Funds And ETFs

Before diving into strategies, it’s essential to grasp the basics of these investment options:

Mutual Funds: Pooled investment vehicles managed by professional fund managers. They invest in a diversified portfolio of stocks, bonds, or other securities, with investors owning shares of the fund.

ETFs: Similar to mutual funds but traded on stock exchanges like individual stocks. ETFs typically follow a specific index, such as the S&P 500, and offer greater trading flexibility.

Both options provide a level of diversification that’s hard to achieve through individual stock investments.

Benefits Of Investing In Mutual Funds And ETFs

Diversification: Spreading investments across various sectors reduces risk.

Accessibility: Low minimum investment requirements make them accessible to a broad audience.

Liquidity: ETFs offer high liquidity due to their stock-like trading characteristics.

Professional Management: Mutual funds are actively managed by financial experts aiming to maximize returns.

Steps To Begin Your Investment Journey

Define Your Investment Goals

Are you saving for retirement, a house, or education? Your financial goals determine the type of funds you should consider. Long-term goals align with equity funds, while short-term objectives might favor bond or money market funds.

Assess Your Risk Tolerance

Evaluate how much risk you’re willing to take. Aggressive investors may lean toward growth-oriented funds, while conservative investors might prefer income-focused or balanced funds.

Understand Fund Categories

Equity Funds: Focus on stocks and offer high growth potential but come with higher risk.

Bond Funds: Invest in fixed-income securities and are ideal for risk-averse investors.

Index Funds and ETFs: Track market indices and provide cost-efficient exposure to market trends.

Evaluate Expense Ratios

Review the fund’s expense ratio, which impacts your net returns. ETFs generally have lower expense ratios compared to actively managed mutual funds.

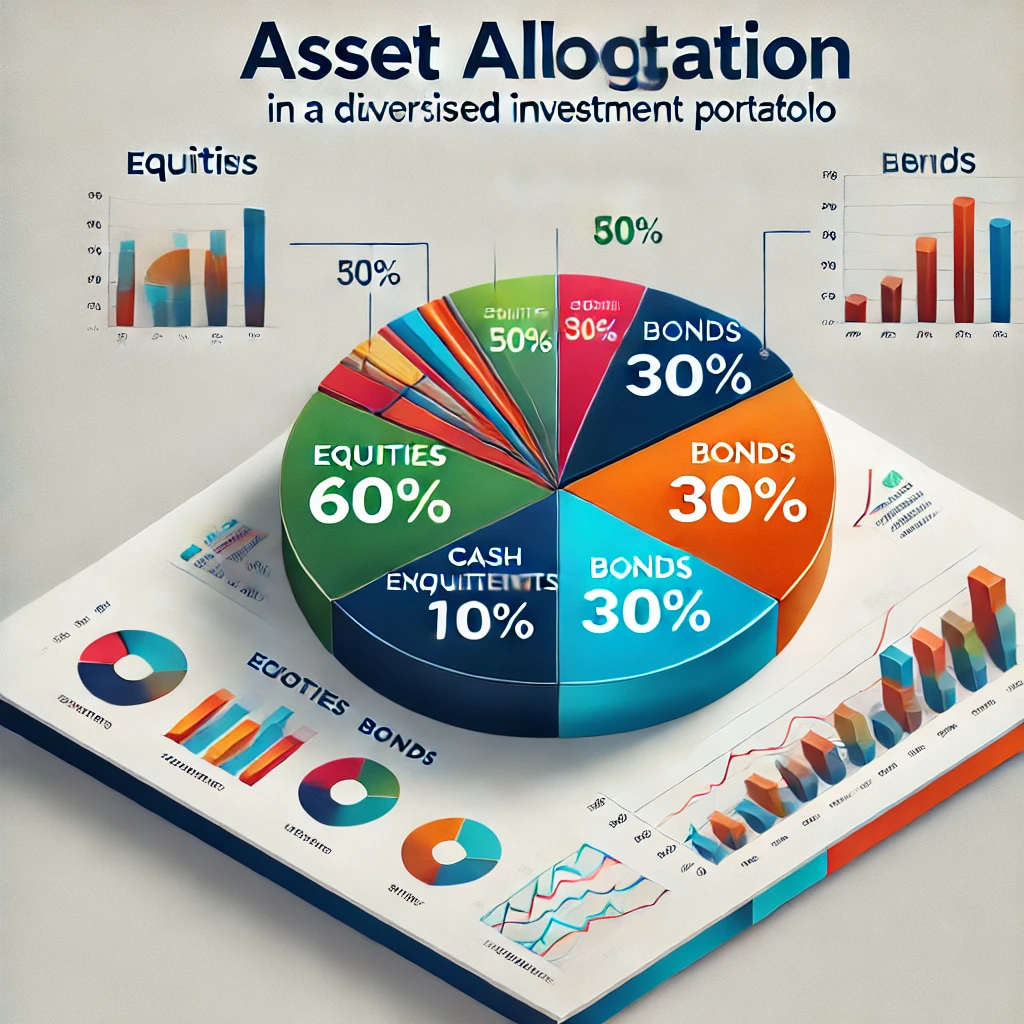

Building A Diversified Portfolio

Diversification is the cornerstone of a resilient investment portfolio. It mitigates risk by spreading investments across asset classes, sectors, and geographies.

Mix Asset Classes

Balance equities, bonds, and cash to match your risk appetite and investment horizon.

Sector Allocation

Include funds from various sectors, such as technology, healthcare, and consumer goods, to reduce dependency on a single industry.

Geographical Diversification

Consider global ETFs or international funds to gain exposure to emerging markets and other economies.

Time Your Investments

Use dollar-cost averaging to invest regularly over time, minimizing the impact of market volatility.

Comparing Active Vs. Passive Management

Active Management: Fund managers actively select securities, aiming to outperform the market. Suitable for investors seeking higher returns and willing to pay higher fees.

Passive Management: Funds replicate an index’s performance, offering lower fees and consistent returns. Ideal for cost-conscious investors seeking steady growth.

Common Mistakes To Avoid

Overconcentration in One Fund

Avoid putting all your money into a single fund. Spread investments across multiple funds with varying strategies.

Ignoring Fees

High fees can erode returns. Always compare expense ratios before investing.

Chasing Performance

Past performance doesn’t guarantee future results. Look at long-term trends rather than short-term gains.

Neglecting Rebalancing

Periodically review your portfolio and adjust allocations to maintain your desired risk level.

Leveraging Technology And Tools

Use financial apps and platforms to analyze fund performance, expense ratios, and historical data.

Robo-advisors can automate investment strategies, providing tailored recommendations based on your goals.

Tax Implications Of Mutual Funds And ETFs

Understand the tax consequences of your investments:

Capital Gains Tax: Taxes on the profit from the sale of fund shares.

Dividend Tax: Taxes on distributions from funds, which vary based on the investor’s income bracket.

ETFs are generally more tax-efficient than mutual funds due to their unique structure.

Navigating Market Volatility

Stay Invested

Avoid panic selling during market downturns. Markets typically recover over time.

Focus on Long-Term Goals

Short-term fluctuations shouldn’t deter you from your financial objectives.

Maintain a Cash Reserve

Keep some funds in liquid assets to cover emergencies without dipping into your investments.

Conclusion

Investing in mutual funds and ETFs offers an excellent pathway to financial growth and security. By understanding your goals, assessing risk, and diversifying intelligently, you can build a robust portfolio. Regular monitoring and staying informed about market trends will further enhance your investment journey.