Introduction

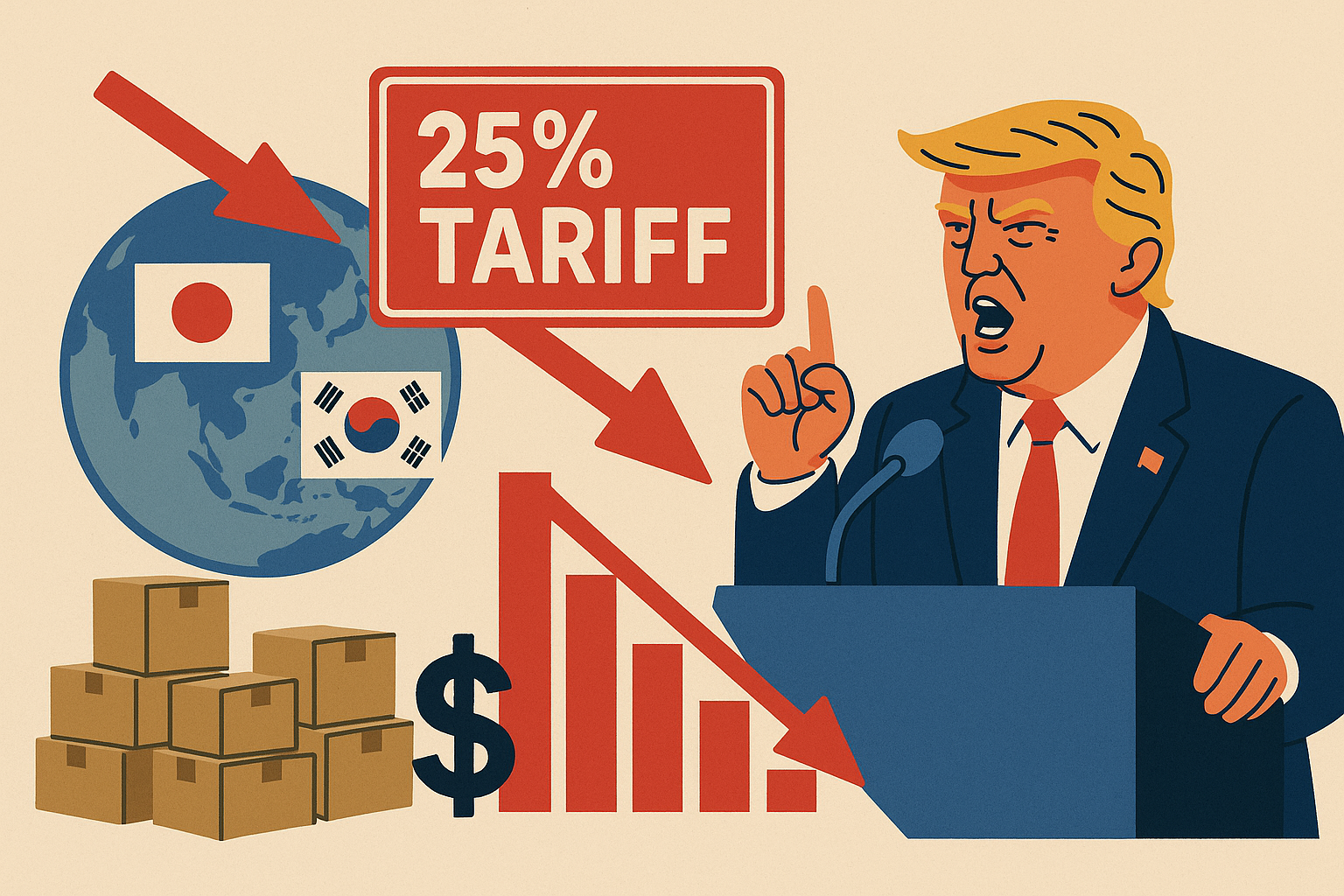

In a dramatic return to the spotlight, former U.S. President Donald Trump has reignited global economic tensions by announcing plans to impose 25% tariffs on imports from Japan and South Korea if he returns to office in 2025. This development has sent ripples through global markets and reopened painful memories of past trade wars. The policy, part of Trump’s broader “America First” agenda, aims to target countries he claims benefit disproportionately from trade with the United States. The announcement raises immediate concerns for industries, investors, and governments alike.

Understanding The Context: Trump’s Trade Legacy

During his first term, Trump upended traditional U.S. trade policy by imposing aggressive tariffs on China, the European Union, and even longtime allies like Canada and Mexico. These moves were justified under Section 232 of the Trade Expansion Act, which allows tariffs for national security reasons. While some sectors benefited from this protectionism, many industries—especially manufacturing and agriculture—suffered retaliatory actions. Supply chains were disrupted, consumer prices rose, and business uncertainty increased. The reintroduction of tariffs now threatens to reignite those same dynamics.

The Announcement: What Trump Said And Why It Matters?

At a campaign rally and during closed-door discussions with foreign envoys, Trump reportedly declared that countries such as Japan and South Korea have “taken advantage” of the U.S. by maintaining trade surpluses and limiting American access to their markets. He proposed sweeping 25% tariffs on certain categories of goods, especially electronics, automotive parts, and steel-based products. These countries were chosen not just for economic reasons, but also to signal a shift in geopolitical alignment and remind the public of Trump’s willingness to confront even U.S. allies.

Targeting Japan And South Korea: Why These Countries?

Japan and South Korea are two of America’s closest security allies in Asia, but they are also major exporters to the U.S., especially in high-tech sectors. South Korea’s Hyundai and Samsung, and Japan’s Toyota, Sony, and Panasonic all have strong presences in the U.S. market. By imposing tariffs, Trump seeks to create a wedge in this mutually beneficial relationship, leveraging American consumption power to force these nations to the negotiating table. However, this strategy risks backfiring, both diplomatically and economically.

Economic Ramifications: Supply Chains Under Pressure

Modern supply chains are globally integrated. Tariffs on imports from Japan and South Korea will not just affect foreign producers—they will hurt American businesses that rely on intermediate goods. For example, U.S. automakers like Ford and GM import crucial components from Asia. A 25% tariff would raise costs, reduce competitiveness, and potentially lead to job losses. Furthermore, the consumer electronics industry would face price hikes as components for devices like smartphones and laptops become more expensive.

Diplomatic Fallout: Risking Key Alliances

One of the most alarming aspects of the proposed tariffs is the potential damage to America’s strategic alliances in the Asia-Pacific region. Both Japan and South Korea are pivotal in counterbalancing China’s influence. Imposing economic penalties could undermine cooperation on security, intelligence sharing, and regional stability. It also weakens the united front that the U.S. has tried to maintain with allies in confronting threats from North Korea and navigating the Taiwan Strait crisis.

Stock Market Reaction: Jitters And Volatility

Following the tariff announcement, markets responded with caution. Technology and automobile stocks showed signs of vulnerability, especially companies with significant exposure to Asian imports. While U.S. indices remained relatively stable due to strong domestic earnings, Asian markets—particularly in Tokyo and Seoul—saw sharp intraday declines. Investors are bracing for a broader escalation of trade tensions, potentially leading to a repeat of the turbulence witnessed during the 2018-2019 U.S.-China trade war.

Corporate Responses: Preparing For Impact

Major corporations in the crosshairs of the new tariff threats have begun internal assessments and contingency planning. Hyundai and Toyota have expressed concern over the potential increase in costs and disruption of U.S.-based manufacturing. Tech companies that depend on components from South Korea, including Apple and Intel, may be forced to diversify their supply chains or absorb cost increases. Many firms are revisiting their risk models and accelerating regional diversification.

Consumer Impact: Higher Prices On Everyday Goods

The everyday American consumer stands to be among the hardest hit. A 25% tariff would eventually translate to higher prices at the cash register for goods like electronics, vehicles, appliances, and more. Retailers would have limited capacity to absorb such costs, passing them down to buyers. Given the already elevated inflation levels in the U.S., this could aggravate cost-of-living pressures and reduce household spending power.

Political Strategy: Appealing To The Base

Trump’s tariff proposal is not just an economic instrument—it’s a political strategy. By casting foreign nations as exploiters of American goodwill and industry, he energizes his base and portrays himself as a defender of U.S. manufacturing. This rhetoric resonates especially in key battleground states with struggling industrial sectors. It allows him to distinguish himself from President Biden’s more diplomatic approach to international trade and capitalizes on growing economic nationalism among voters.

Legal And Institutional Challenges

Implementing a 25% tariff will not be without hurdles. Under the U.S. Constitution, Congress holds the power to regulate commerce with foreign nations. While Trump used executive powers in his previous term, any renewed actions may face pushback from lawmakers, courts, and business lobbies. Already, multiple trade groups have warned of the risks and legal ambiguity surrounding such unilateral moves. If Trump were reelected and pursued these measures, a flurry of legal battles could ensue.

Global Response: Retaliation Or Diplomacy?

It is unlikely that Japan or South Korea would remain passive. In past instances, countries targeted by U.S. tariffs have responded with retaliatory tariffs or restrictions on American exports. For example, China imposed tariffs on U.S. soybeans and agricultural products during the previous trade conflict. Japan and South Korea could adopt similar measures, impacting U.S. companies in agriculture, aerospace, and pharmaceuticals. Alternatively, they may seek resolution through diplomatic channels or international trade bodies like the WTO.

Lessons From The Past: 2018–2019 Trade War

The world has not forgotten the economic fallout from Trump’s earlier tariffs. The trade war with China disrupted global supply chains, eroded investor confidence, and contributed to a manufacturing slowdown. While Trump claimed the tariffs brought jobs back, data suggests the benefits were uneven and often offset by retaliatory measures. Many analysts warn that repeating such a strategy could result in prolonged economic uncertainty and undermine post-pandemic recovery efforts.

What Comes Next: Scenarios And Outlook

There are multiple potential paths forward. If Trump secures re-election and follows through, global markets could brace for a new wave of trade disruptions. Multinational corporations may accelerate reshoring or move operations to tariff-free regions. If Biden retains office, these threats could still pressure allies into renegotiating trade terms preemptively. Regardless of the political outcome, the rhetoric itself already influences decision-making across the public and private sectors.

Conclusion

Trump’s tariff threat is more than just a policy proposal—it’s a signal of how the 2025 race could reshape the global economic landscape. At stake are not just prices and profits but also strategic relationships, global supply chains, and the future of international trade. Whether this move will protect American jobs or create new economic frictions remains to be seen. What is clear is that the era of global cooperation is being challenged once again by the rise of economic nationalism.