Introduction The World of Hyatt Credit Card is widely recognized as one of the most rewarding hotel credit cards available to travelers who want t

Read MoreIntroduction In 2025, American households are feeling mounting financial pressure as inflation, high interest rates, and stagnant wage growth sque

Read MoreIntroduction As October 2025 begins, credit card users continue to face record-high interest rates despite recent moves by the Federal Reserve to

Read MoreIntroduction Australia’s payments landscape is entering a critical moment as the Reserve Bank of Australia (RBA) considers a sweeping ban on credi

Read MoreIntroduction The U.S. credit card industry is undergoing one of its most significant shifts in over a decade. Major banks and credit card issuers

Read MoreIntroduction In a world where nearly every major financial decision hinges on your creditworthiness, understanding and maintaining a healthy credi

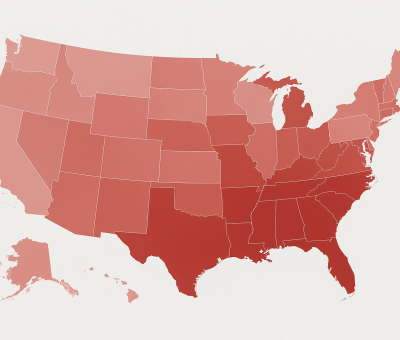

Read MoreIntroduction As of mid-2025, the American credit landscape has taken a dramatic turn. According to recent data from financial institutions and fed

Read MoreIntroduction Cash-back credit cards are an excellent choice for those who want to earn rewards on everyday spending without dealing with the compl

Read MoreIntroduction Credit cards with 0% APR introductory offers can be a game-changer for those looking to manage debt, finance large purchases, or impr

Read MoreIntroduction In a competitive and evolving financial services market, Neo Financial has made headlines with its groundbreaking launch of cashback

Read More