Introduction

The U.S. credit card industry is undergoing one of its most significant shifts in over a decade. Major banks and credit card issuers are tightening lending standards, raising minimum credit score requirements, and restricting approvals in response to rising default rates. This shift reflects growing concerns over household debt, rising interest costs, and a broader economic slowdown. For consumers who rely heavily on credit cards, the move signals more difficult access to credit at a time when inflation and borrowing costs are already weighing heavily on household budgets.

The Growing Wave Of Credit Card Defaults

In 2025, U.S. credit card debt has surpassed $1.3 trillion, a record high. This surge in balances has been fueled by persistent inflation in essential goods and services, coupled with the Federal Reserve’s higher interest rate policy designed to fight inflation. Average credit card APRs have climbed above 24%, making it increasingly difficult for consumers to manage revolving debt.

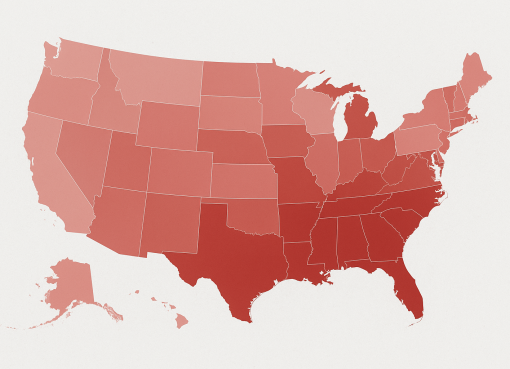

As a result, delinquency rates — payments that are 30 days or more overdue — have been steadily rising, particularly among younger borrowers and lower-income households. According to data from the Federal Reserve Bank of New York, credit card delinquency rates are now at their highest level since the Great Recession. This worrying trend has forced lenders to adopt stricter standards in an effort to minimize losses.

Why Are Lenders Tightening Credit?

Credit card issuers operate in a high-risk environment, as unsecured debt is more difficult to recover than secured loans such as mortgages or auto loans. When default rates climb, lenders’ profit margins quickly erode. By raising credit score requirements, reducing credit limits, and tightening approval processes, banks aim to filter out riskier borrowers before defaults accelerate further.

Additionally, regulatory pressures are playing a role. Federal regulators have urged financial institutions to take a more conservative approach to lending practices as concerns about financial stability rise. Lenders are responding by scrutinizing borrower profiles more closely and adjusting internal risk models to prepare for a potential economic slowdown.

Impact On Consumers

The immediate consequence of tighter lending standards is reduced access to credit. Consumers with marginal credit histories or lower credit scores are finding it increasingly difficult to secure new cards or credit line increases. Even existing cardholders may experience reduced credit limits, which can increase credit utilization ratios and further hurt their credit scores.

For households already struggling with inflation, reduced access to credit means fewer options for managing cash flow. This is particularly challenging for families that use credit cards as a financial buffer between paychecks. At the same time, balance transfer cards with promotional low interest rates are becoming a popular but limited solution for those trying to escape high APR debt.

The Economic Backdrop

The tightening of credit card lending standards is occurring against a backdrop of economic uncertainty. While inflation has moderated slightly from its peak in 2022–2023, prices remain elevated compared to pre-pandemic levels. Wage growth, though improving, has not kept pace with the cost of living, leaving many households stretched thin.

Meanwhile, the Federal Reserve has signaled that interest rates may remain higher for longer to keep inflation under control. This monetary policy stance has increased the cost of borrowing across all forms of credit, from mortgages to auto loans, adding to consumer financial strain. In this environment, credit card defaults are likely to remain elevated, prompting further caution among lenders.

How Banks Are Adjusting Their Risk Strategies?

To navigate this challenging landscape, banks are employing several risk management strategies:

Higher Credit Score Requirements: Borrowers now often need scores well above 700 to access premium credit card products.

Stricter Income Verification: Lenders are demanding more thorough documentation of employment and income before approving applications.

Lower Credit Limits: Even approved applicants may receive smaller credit lines than in previous years.

Increased Monitoring: Card issuers are using advanced data analytics to monitor spending behaviors that might indicate financial stress.

These strategies are designed not only to reduce default exposure but also to protect the overall financial health of institutions as credit conditions tighten.

The Role Of Balance Transfer Cards

While banks are cautious, balance transfer cards have emerged as a double-edged sword. On one hand, they provide temporary relief to consumers by allowing them to consolidate high-interest balances under lower promotional rates. On the other, they expose lenders to additional risks if consumers fail to pay down balances before promotional periods expire.

The rising popularity of these products highlights the growing desperation among households to manage debt. However, the tightening of standards means not all borrowers will qualify, further stratifying access to relief options.

Long-Term Implications For The Economy

Tighter credit conditions can have ripple effects across the broader economy. As access to revolving credit shrinks, consumer spending is likely to decline. Since consumer spending accounts for roughly 70% of U.S. GDP, any slowdown could deepen concerns about a potential recession.

Moreover, the contraction in credit availability disproportionately impacts lower- and middle-income households, who are more reliant on credit cards for everyday expenses. This could widen existing wealth gaps and contribute to social and economic inequality.

How Consumers Can Prepare?

For individuals facing tighter credit conditions, proactive financial management is essential:

Pay Down Balances: Reducing outstanding balances improves credit scores and lowers interest expenses.

Build Emergency Savings: Having cash reserves lessens dependence on credit cards.

Explore Alternatives: Personal loans with fixed rates may offer lower-cost borrowing compared to revolving credit.

Monitor Credit Reports: Regularly checking credit reports helps identify and address potential issues before applying for new credit.

Financial literacy and discipline will become increasingly important as credit access tightens. Consumers who adapt early may weather the changes more effectively than those who continue to rely heavily on revolving debt.

The Outlook For 2025 And Beyond

Looking ahead, the trajectory of credit card lending will depend heavily on economic conditions. If inflation moderates further and wage growth accelerates, consumers may regain stability and default rates could ease. This would allow lenders to gradually loosen standards again.

However, if economic pressures persist — particularly if interest rates remain elevated or unemployment begins to rise — defaults may continue to climb. In such a scenario, lenders are likely to maintain or even increase their cautious stance, further restricting access to credit.

For now, credit card issuers are signaling that they are prioritizing risk management over growth. This cautious approach reflects both lessons learned from past crises and a recognition of current economic vulnerabilities.

Conclusion

The tightening of credit card lending standards marks a turning point in the consumer finance landscape. Driven by rising defaults, economic uncertainty, and the burden of high interest rates, banks and credit card issuers are adopting stricter risk management strategies. While these measures are designed to protect financial institutions, they also place added strain on households already navigating inflation and stagnant wage growth.

For consumers, the era of easy access to credit cards is giving way to one of heightened scrutiny and restricted borrowing. The challenge ahead lies in balancing responsible financial behavior with adapting to a tighter credit environment. For policymakers and regulators, the focus will be on ensuring that financial stability is maintained without disproportionately excluding vulnerable populations from access to credit.