Introduction

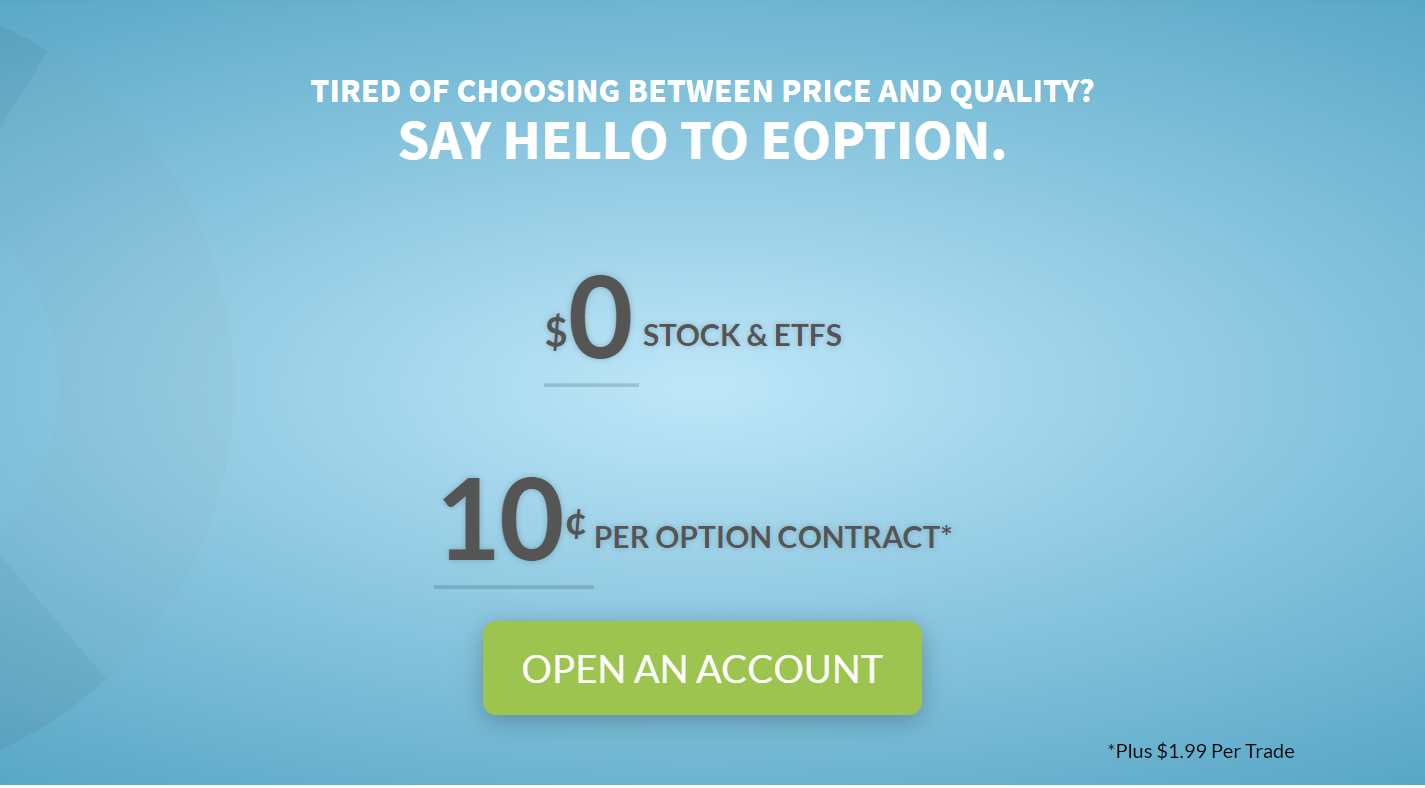

Founded in 2007, eOption had long been the ideal broker for active traders who are managing high-volume positions. Based in Milwaukee Ave, Illinois, it is a broker regulated by FINRA and is well-known for charging no commission for stocks and ETFs, as well as low commissions for options trading.

However, since most of the major brokers had also lowered the commissions to $0 for US-based assets, eOption had lost some competitive advantage, but still, we would like to highlight some of their features, in order to make traders understand what this company offers and whether it’s the right broker for them.

Platforms

Based on the information available on the eOption website, the desktop platform comes with a series of cutting-edge and easy-trading features, designed to maximize the trading experience with stocks, options, and many other instruments.

The eOption mobile seems to be at the core of the offer, offering a convenient mobile trading solution. Its advantages are faster transfer speeds, reliability, and extended functionalities. It comes with an intuitive design, enabling clients to place multiple order types, while also managing different account metrics.

OptionsPlay is a platform designed mainly for stocks and options trading, making exploring, analyzing and trading easier than ever. There are a few videos on the broker’s website showing how to use it. On top of that, eOption offers Direct Access Trading through the Sterling Trader Pro, DAS/WEB, and DAS/Pro, three advanced trading platforms designed for professional traders.

DMA Trading

When it comes to trading conditions, eOption shines when it comes to low options contract fees. The cost to trade options is $1.99 plus a per-contract fee of 10 cents, which means traders who buy/sell a minimum of 4 contracts per trade will get to pay less, as compared to other brokers charging around $0.65 per contract.

The broker-assisted trade costs are also small on stocks, options, and ETFs: an additional $6 in most of the cases, much less than $20, $25 charged by other companies. Automated trading is another important feature of eOption, which can be authorized to automatically execute recommended trades from the newsletter.

On the negative side, the broker allows only non-US residents from some countries to open an international account with a minimum of $25,000 (a combination of cash and securities). There’s also an annoying $50 inactivity fee on accounts that go 12 months without at least 2 executed trades.

Pros and Cons

- Relatively-low options contract fees.

- Low margin rates.

- eOption serves international investors from a few countries other than the US.

- The web-based trading platform is basic when it comes to features.

- Limited data and research provided.

- An inactivity fee of $50 per year.

Summary

To conclude, eOption is a decent alternative for traders who want to trade stocks and options for little commission. However, as seen in our review, there are some weak points as well, which means each trader will need to put them in the balance and decide whether it’s worth trading with eOption.

eOption Review

Product Name: eOption

Product Description: Founded in 2007, eOption had long been the ideal broker for active traders who are managing high-volume positions. Based in Milwaukee Ave, Illinois, it is a broker regulated by FINRA and is well-known for charging no commission for stocks and ETFs, as well as low commissions for options trading. However, since most of the major brokers had also lowered the commissions to $0 for US-based assets, eOption had lost some competitive advantage, but still, we would like to highlight some of their features, in order to make traders understand what this company offers and whether it’s the right broker for them.

Brand: eOption

Offer price: 100$

Currency: USD / EUR / GBP

Offer URL: https://www.eoption.com/

-

Trading Platform

-

Languages

-

Spread

-

Support

Summary

To conclude, eOption is a decent alternative for traders who want to trade stocks and options for little commission. However, as seen in our review, there are some weak points as well, which means each trader will need to put them in the balance and decide whether it’s worth trading with eOption.