Introduction

As of mid-2025, the American credit landscape has taken a dramatic turn. According to recent data from financial institutions and federal reports, consumers in the United States are carrying a record amount of credit card debt. The numbers are staggering: average annual percentage rates (APRs) are hovering around 21 percent, and the collective credit card balance across U.S. households has surpassed every historical benchmark on record.

While some of this growth can be attributed to an expanding economy and increased consumer spending, the core of the problem runs much deeper. Inflation continues to outpace wage growth in several regions, leaving families increasingly dependent on credit cards not for luxury spending, but to meet daily necessities such as groceries, rent, and healthcare.

How The Economy Set The Stage For A Debt Crisis?

To understand how American households reached this tipping point, we must look back at the broader macroeconomic forces at play. In the aftermath of the post-pandemic recovery, inflation surged beyond manageable levels. Although the Federal Reserve responded with a series of interest rate hikes, the pace of inflation remained stubbornly high throughout 2023 and 2024.

By early 2025, while inflation had slightly cooled from its peak, consumer goods and services were still significantly more expensive than they were just a few years earlier. This persistent cost pressure, combined with stagnant real wage growth, left many Americans with limited options for maintaining their standard of living. Turning to credit cards became a default financial survival tactic.

APR Levels Reach A Painful High

One of the most notable aspects of the 2025 credit card debt landscape is the unprecedented APR levels. Financial analysts from Yahoo Finance and CNBC both confirm that most credit card APRs have climbed past 21 percent, setting a new record. For comparison, just five years ago, the average rate was closer to 15 percent.

The sharp rise in APRs is largely a byproduct of the Federal Reserve’s monetary policy. As part of its inflation control strategy, the Fed has kept its benchmark interest rate above 5 percent since mid-2024. This elevated base rate ripples across all forms of consumer lending, but none more visibly than revolving credit like credit cards.

Unfortunately, this has created a vicious cycle for consumers. As APRs increase, so does the cost of carrying a balance. Many households now find themselves in a trap where minimum payments barely cover interest, causing balances to grow month after month.

Delinquencies On The Rise: A Warning Signal

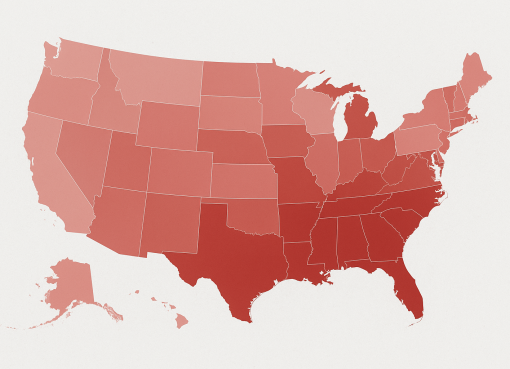

Perhaps more concerning than the sheer amount of debt is the sharp increase in delinquencies. According to a June 2025 report by CNBC, credit card delinquencies—defined as accounts that are at least 90 days past due—are steadily climbing. The groups most affected include young adults, low-income families, and individuals in economically vulnerable regions of the country.

Federal Reserve data confirms that while the overall economy remains relatively stable, these pockets of financial stress are expanding. Analysts caution that rising delinquencies are often a leading indicator of a weakening consumer base and may foreshadow broader economic downturns.

Lenders have taken notice. Several major banks have begun tightening their underwriting standards, making it more difficult for subprime borrowers to qualify for new credit. This may help mitigate some risk for financial institutions, but it also cuts off access to emergency funds for many Americans already struggling.

Spending Behavior Shifts Toward Essentials

Historically, credit card usage was often associated with discretionary spending—vacations, electronics, and lifestyle purchases. But recent surveys show a dramatic change. In 2025, a growing percentage of credit card transactions are for basic living expenses.

This shift highlights how deeply inflation has affected everyday life. With food prices up by more than 12 percent since 2023 and rent increasing steadily in major cities, many consumers have no choice but to lean on plastic to bridge the gap between income and expenses.

Additionally, utilities and transportation costs have remained elevated. When combined with student loan payments, which resumed in 2024 after years of deferment, household budgets are stretched to their breaking point.

Rewards Cards Remain Popular Despite Financial Pressures

Amid the rising debt crisis, one somewhat surprising trend has emerged: credit card rewards programs are thriving. A recent review by Investopedia revealed that 2025 has seen aggressive competition among credit card issuers to lure new customers with high-value incentives.

From cash-back categories on groceries and gas to large travel points bonuses, banks are investing heavily in retaining customer loyalty. For consumers who pay off their balances each month, these programs offer tangible value. However, for those carrying ongoing debt, the allure of rewards can be dangerously misleading.

The concern here is that promotional offers and rewards programs may encourage consumers to open new accounts or spend beyond their means. In a time of heightened financial fragility, the short-term appeal of rewards may lead to long-term financial strain.

The Demographic Divide: Who Is Struggling Most?

While credit card debt is rising across all income levels and age groups, the impact is far from uniform. Federal Reserve data and credit bureau analytics show that millennials and Gen Z borrowers are shouldering a disproportionate share of this burden.

Younger consumers are more likely to rent rather than own, and many entered adulthood during periods of economic uncertainty. As a result, their access to wealth-building assets is limited. Coupled with rising student debt and relatively lower incomes, these groups are turning to credit cards to stay afloat.

In contrast, older generations—particularly those who own homes or have established retirement savings—are less likely to be carrying significant credit card balances. This disparity raises long-term concerns about generational financial inequality and future economic mobility.

Credit Bureaus And Lenders Brace For Repercussions

The surge in credit card debt has not gone unnoticed by the institutions that manage credit scoring and lending practices. Experian, one of the three major credit bureaus, has reported an uptick in the average credit utilization ratio across the U.S. This ratio, a key component of credit scores, measures how much credit consumers are using compared to their total limit.

A higher utilization rate typically results in lower credit scores, which can have a cascading effect. Consumers with declining scores may find it harder to secure car loans, mortgages, or even employment in industries that conduct credit checks.

Lenders, meanwhile, are reevaluating their exposure to risk. Some have started to pull back on marketing to lower-credit segments and are increasing interest rates even further on variable-rate cards. These defensive moves, while logical from a business perspective, may accelerate the credit crisis by restricting access to capital for those who need it most.

What Can Be Done? Policy And Consumer Solutions

Experts agree that addressing the growing credit card debt problem will require both policy intervention and improved financial literacy. On the policy side, lawmakers are considering proposals to cap APRs, increase transparency around fees, and regulate aggressive marketing practices. There are also calls for expanded emergency assistance for low-income families, particularly in the form of food subsidies and rent support.

For individual consumers, financial advisors stress the importance of budgeting, credit counseling, and debt consolidation strategies. Programs such as the National Foundation for Credit Counseling offer resources to help households manage their finances and avoid long-term damage to their credit profiles.

Conclusion

The current credit card debt crisis in America is more than a statistical anomaly—it is a symptom of deep-rooted economic pressure. As APRs soar and household costs remain high, millions of Americans find themselves teetering on the edge of financial instability. While some consumers may navigate their way through this challenge with prudent planning and discipline, many more are at risk of falling into a cycle of debt from which it will be difficult to recover.

The coming months will be critical. As policymakers, lenders, and households confront this complex challenge, the decisions made today will shape the financial health of the nation for years to come.