Introduction

Operated by Trade Capital Markets Ltd (authorized and regulated by CySEC) and Livemarkets Limited (authorized and regulated by FCA), trade.com is a trading name offering direct market access (DMA) to a world of assets. Clients who choose this service will be able to place buy and sell orders directly on global exchanges like NASDAQ and LSE. Among the assets available for trading, we can mention stocks, ETFs, warrants, options, futures, FOPS, fixed income, and mutual funds. It should also be clear that the trade.com DMA service is powered by Interactive Brokers, another important name from the industry.

Platforms

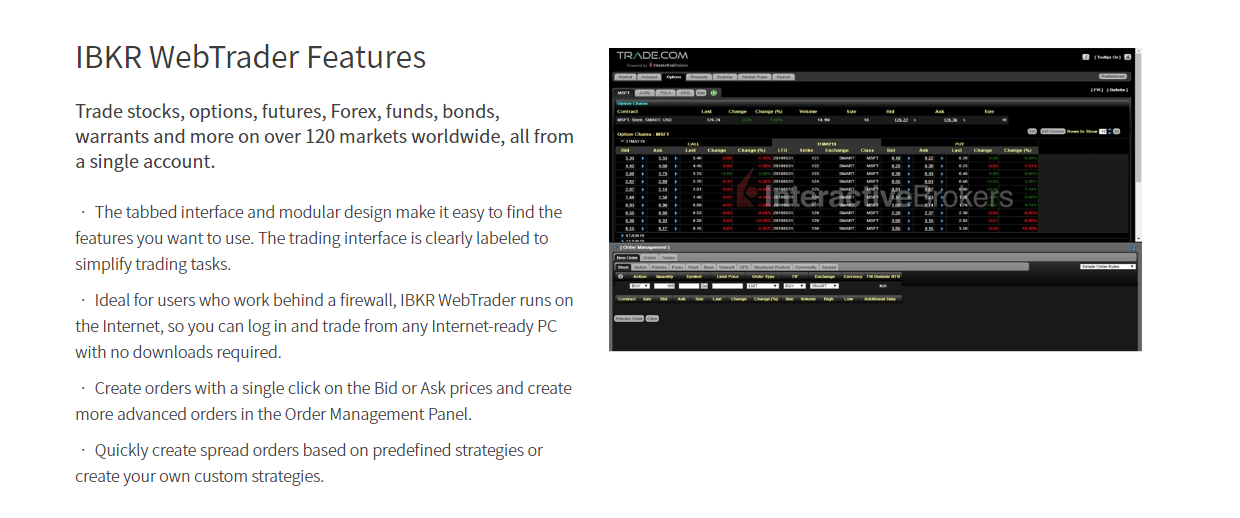

Access to all trade.com DMA services are ensured via the Interactive Brokers (IBKR) WebTrader. It is an HMTL-based trading platform, suited for clients wanting a simple user-interface, yet with plenty of features and advanced tools for more experienced traders. With the platform, clients can trade stocks, options, futures, Forex, funds, bonds, warrants, and other instruments on over 120 markets worldwide, all from a single account.

As it was excepted from a DMA platform, it comes with a series of advanced tools. The Market Depth displays the alternative bids and offers away from the inside quote to allow a better gauge of the market liquidity. The BookTrader lets clients view a deep order book data for a selected instrument, as well as creating and transmitting orders. We should also mention the modular design of the IBKR Webtrader, which allows clients to add and remove trading functions and tools in order to make the platform fit for any particular trading style.

DMA Trading

The trade.com DMA offer is very rich when it comes to instruments. Stocks, ETFs, and warrants on 120 exchanges, options, futures & FOPS spanning 30 markets, over 38,000 global corporate bonds and 1.4 million US municipal issues, as well as more than 11,000 mutual funds, are currently supported.

In terms of trading conditions, people who open an account and start trading in DMA products must make a minimum deposit of $5,000/€5,000. It must also be mentioned that there are commissions attached, starting from 0.02 USD for Stocks, ETFs, and warrants, and a minimum of 2 USD/contract for options. The full list of commission can be found here. On top of that, there are several fees to be taken into account (inactivity fee, conversion fees, dividend processing fee, security transfer fee, etc)

Summary

The trade.com DMA service is provided by a reliable company, with plenty of instruments available for trading. Strong regulation and experience recommend this broker, but still, commissions may seem too high for some traders who already worked with other DMA brokers.

Trade.com Review

Product Name: Trade.com

Product Description: Operated by Trade Capital Markets Ltd (authorized and regulated by CySEC) and Livemarkets Limited (authorized and regulated by FCA), trade.com is a trading name offering direct market access (DMA) to a world of assets. Clients who choose this service will be able to place buy and sell orders directly on global exchanges like NASDAQ and LSE. Among the assets available for trading, we can mention stocks, ETFs, warrants, options, futures, FOPS, fixed income, and mutual funds. It should also be clear that the trade.com DMA service is powered by Interactive Brokers, another important name from the industry.

Brand: Trade.com

Offer price: 100$

Currency: USD / EUR / GBP

Offer URL: https://www.ally.com/invest/

-

Trading Plarform

-

Languages

-

Spread

-

Support

Summary

The trade.com DMA service is provided by a reliable company, with plenty of instruments available for trading. Strong regulation and experience recommend this broker, but still, commissions may seem too high for some traders who already worked with other DMA brokers.

Pros

- The company offers access to a wide variety of DMA products.

- Highly-reputable and regulated broker, with a long track record in the industry.

- Access to a platform developed by a leading figure from the DMA industry.

Cons

- Only one web-trading platform available, no mobile apps.

- Relatively-high commissions, as compared to other competitors.

- Many fees associated with simple tasks performed by the company.