Introduction

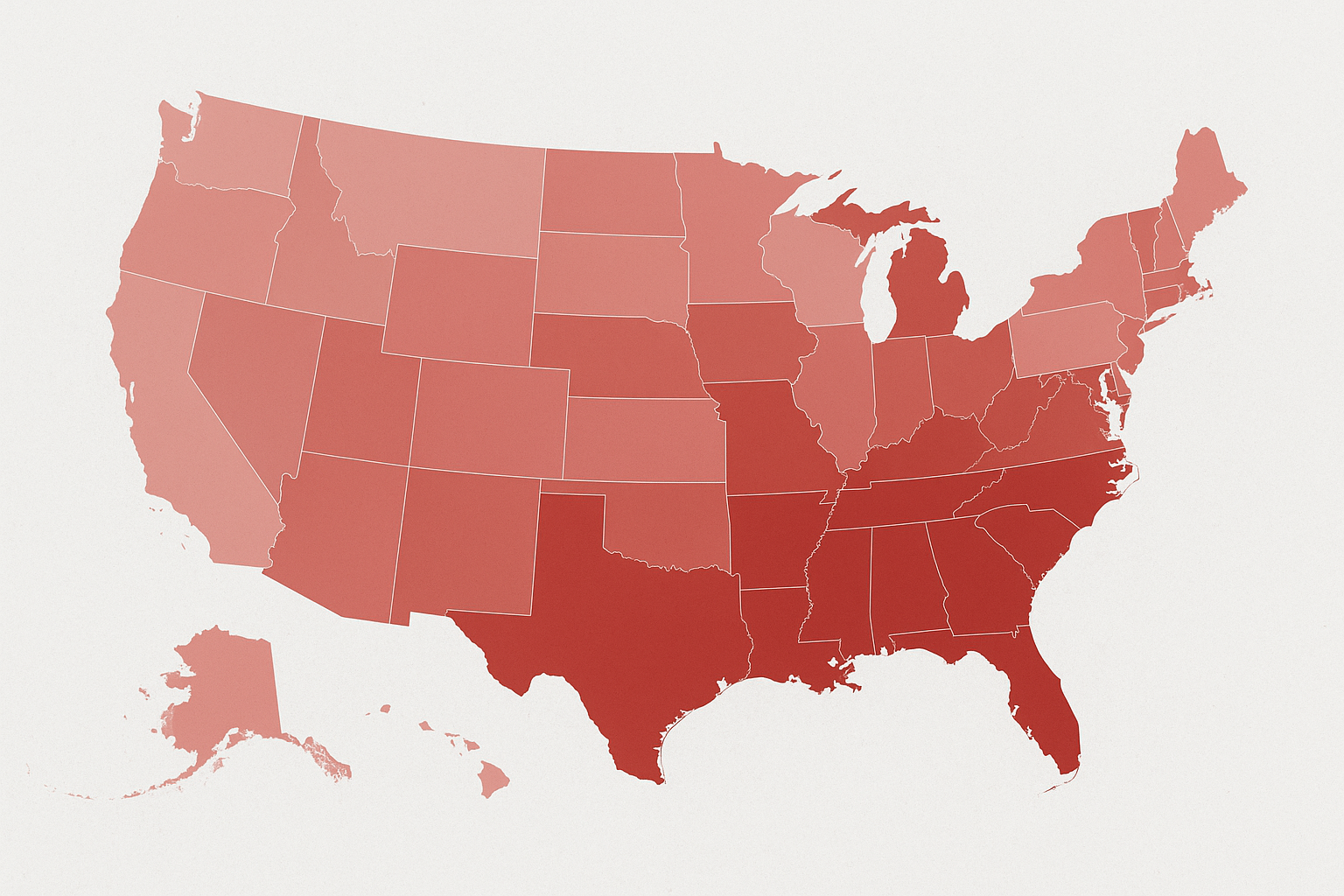

In 2025, American households are feeling mounting financial pressure as inflation, high interest rates, and stagnant wage growth squeeze budgets. The result has been a sharp rise in credit card delinquencies — accounts that are 30 or more days past due. Recent data shows that delinquency rates have surged in many states, with some experiencing increases of more than 30 percent in just one quarter.

While the rise is nationwide, certain regions are seeing far greater jumps than others, revealing a divide in household financial resilience across the United States. Understanding why delinquencies are climbing — and how to respond — is crucial for consumers, lenders, and policymakers alike.

What Is Credit Card Delinquency?

A credit card becomes delinquent when the cardholder fails to make at least the minimum payment by the due date. Once a payment is more than 30 days late, it’s reported to credit bureaus, which can significantly damage a consumer’s credit score. Continued delinquency — at 60 or 90 days — can lead to late fees, penalty interest rates, account closures, and even charge-offs where the lender writes off the debt as uncollectable.

Credit card delinquency is more than an individual problem. On a large scale, it’s a key indicator of household financial health and economic stability. Rising delinquency rates suggest that families are under growing financial strain — often due to higher living costs, job market challenges, or insufficient savings buffers.

Key Findings From Recent Data

A recent analysis comparing the first and second quarters of 2025 shows that credit card delinquencies increased dramatically in many states. Some of the most notable findings include:

Minnesota saw the largest increase in delinquency rates — up by 32.9% quarter over quarter, with nearly one in five card accounts now delinquent.

Iowa followed closely with a 31.5% increase and around 14% of credit card accounts past due.

Kansas, South Dakota, and Ohio also reported jumps of around 30%, each with roughly one-fifth of credit accounts in delinquency.

In contrast, states such as Florida, Vermont, Wyoming, Alaska, and California experienced much smaller increases — between 15% and 19% — suggesting stronger economic resilience or more stable consumer finances.

Nationwide, Americans collectively hold roughly $18.6 trillion in total debt, according to Federal Reserve data. While mortgages make up the bulk of that figure, credit card debt represents a particularly vulnerable category because of its high interest rates and shorter repayment cycles.

Why Are Delinquency Rates Rising?

1. High Interest Rates

Credit card interest rates have climbed to record levels following years of Federal Reserve rate hikes. Most cards carry variable interest rates, meaning they rise automatically when the Fed raises its benchmark rate. This has caused many cardholders to see their interest charges soar, making it harder to pay down balances and easier to fall behind.

2. Persistent Inflation

Even as inflation has moderated from its 2022 peak, prices for essentials like food, rent, utilities, and insurance remain elevated. Households are devoting more of their income to necessities, leaving less room to pay off debt. When budgets tighten, credit card payments are often among the first expenses to slip.

3. Stagnant Wage Growth

While nominal wages have risen, they haven’t kept pace with the cost of living in many regions. This “real wage gap” means families have less purchasing power even if their paychecks are larger on paper. For middle- and lower-income households, this imbalance creates ongoing pressure that often leads to missed payments.

4. Declining Financial Buffers

During the pandemic, many households accumulated savings from government stimulus payments and reduced spending. But by 2025, much of that cushion has been depleted. Without emergency funds, unexpected expenses — from medical bills to car repairs — can push people into delinquency.

5. Regional Economic Disparities

Some states are simply better equipped to weather economic stress. Areas with higher wages, diversified job markets, and strong labor demand have fared better. States reliant on slower-growing industries or rural economies, however, are seeing faster delinquency growth as households struggle to keep up.

States Hit Hardest By Rising Delinquencies

Minnesota

Minnesota leads the nation in delinquency growth, up nearly 33% in a single quarter. Although the state boasts a relatively strong labor market, residents also carry significant levels of consumer debt. Rising prices and interest costs appear to have outpaced income gains, pushing many households into late payment territory.

Iowa

Iowa’s delinquency rate rose by more than 31%, despite the state having relatively low average credit card balances. This suggests that economic conditions — including stagnant wages and limited job growth — may be key drivers. Even modest debt becomes difficult to manage when income growth stalls.

Kansas

Kansas recorded a 30% rise in delinquency rates. Like Iowa, the state’s overall debt burden is modest, but that hasn’t insulated its residents. With inflation cutting into rural and middle-class budgets, many Kansas households are falling behind on payments they could previously afford.

South Dakota

In South Dakota, about one in five credit card accounts is now delinquent. The state’s smaller economic base and relatively lower average incomes may have left consumers especially vulnerable to high borrowing costs and inflationary pressures.

Ohio

Ohio’s economy has been undergoing structural changes, with manufacturing and industrial jobs giving way to lower-paying service roles. The state’s delinquency rate rose nearly 29%, reflecting the financial strain many working families face as living costs rise faster than wages.

States Showing Greater Stability

Not all states are facing severe credit stress. Florida, Vermont, Wyoming, Alaska, and California saw smaller increases in delinquency rates — between 15% and 19%. These regions tend to have stronger labor markets, more diversified economies, or higher average incomes. In some cases, residents may also have more access to financial education and credit counseling resources, helping them avoid or manage delinquency.

Impact On Consumers

Rising delinquency rates have serious consequences for individual borrowers:

Credit Score Damage: Missing payments for 30 days or more can lower a credit score by 50 to 100 points. A lower score makes it harder to qualify for loans, apartments, or even jobs.

Higher Costs: Late fees, penalty APRs, and compounding interest can turn a small missed payment into a long-term financial burden.

Limited Access to Credit: Lenders may lower credit limits or close accounts for delinquent borrowers, further reducing flexibility.

Emotional Stress: Financial strain often translates into anxiety, family tension, and reduced quality of life.

Experts advise that catching up before a payment is 30 days late is critical. Once a delinquency is reported to credit bureaus, it can remain on a credit report for up to seven years.

Impact On Lenders And The Broader Economy

Credit card delinquency is also a warning signal for the financial system. Lenders facing rising delinquencies must increase loan-loss provisions and may tighten lending standards. That, in turn, reduces credit availability for all consumers — even those with good credit — and can slow overall economic growth.

At the macro level, consumer debt distress can weaken spending, which drives roughly two-thirds of the U.S. economy. If more households are focused on paying down or catching up on debt, they spend less on goods and services, dampening demand and economic momentum.

What Policymakers Can Learn?

The uneven rise in delinquency rates highlights how fragile many households remain despite low unemployment and stable GDP growth. Policymakers may consider:

- Strengthening financial literacy programs to help consumers manage variable interest debt.

- Encouraging banks to expand hardship and restructuring programs.

- Monitoring regional disparities and targeting assistance to states with the sharpest increases.

- Supporting wage growth and affordable housing initiatives to reduce household stress.

Looking Ahead

The surge in credit card delinquencies suggests that many families are living on the edge of their financial means. Even states with strong economies are not immune. The data should serve as a wake-up call that inflation, interest rates, and stagnant wages are combining to erode household stability.

If interest rates remain high into 2026 and wage growth continues to lag, delinquencies may rise further. Conversely, if inflation eases and incomes strengthen, the trend could stabilize.

Conclusion

The 2025 rise in credit card delinquencies paints a clear picture of economic stress across the United States. Minnesota, Iowa, Kansas, South Dakota, and Ohio have seen the sharpest increases, while states like Florida and California remain relatively stable.

For consumers, the message is simple but urgent: stay vigilant, make minimum payments on time, and communicate with lenders early if trouble arises. For policymakers and lenders, the growing delinquency trend underscores the need for proactive strategies to protect financial stability and support struggling households.