Introduction

E*Trade is a financial services company offering online brokerage services to its customers at an affordable price. Founded in 1982, it is one of the better known and popular online investment brokers. They were responsible for executing the first electronic trade by an individual investor back in 1983 and ever since their reputation had continued to grow exponentially. With 30 branches in the US, E*Trade offers two trading platforms, a mobile app, 24/7 phone support, online chatting, email support and coverage for a wide range of products (stocks, bonds, mutual funds, ETFs, options, and futures).

Platforms

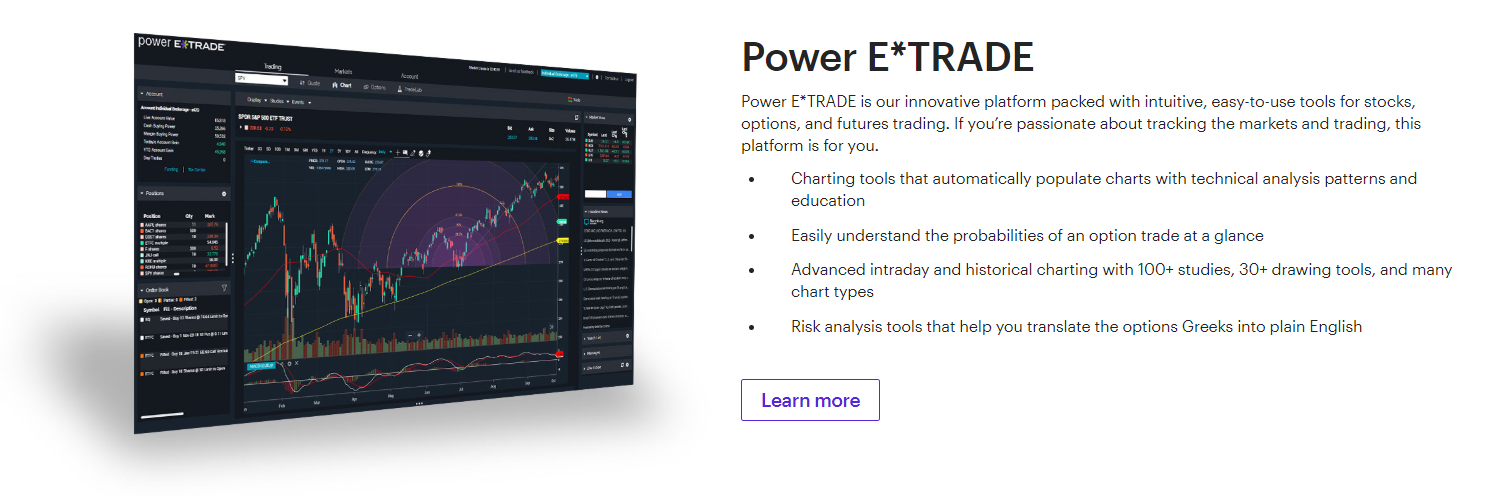

There are two main trading platforms and a mobile app available for E*Trade clients. Firstly, we have the E*Trade Web, which is the basic platform at the company, offering access to live quotes and market commentary, as well as streaming and updated market data. Tracking accounts and pending transactions, designing watch lists for investments that are interesting, and making trades are the most important task to be performed using the platform.

Second of all, for clients who maintain an account balance of $250,000 or more and place a minimum of 30 trades per quarter, the company offers the E*Trade Pro version, designed for active traders. This platform comes with Strategy Scanner and the ability to back-test investments.

Thirdly, the E*Trade mobile app is considered to be one of the most easy-to-use and cleanest in the industry, allowing clients to quickly and easily manage accounts, get quotes, place trades, and other tasks.

DMA Trading

In comparison with other companies, E*Trade does not have a minimum deposit required for a client to open an account. The ability to trade ETFs, mutual funds, options, futures, stocks, and bonds, for commissions as low as 0 in some cases (make sure to check their website for detailed information) and a series of valuable educational resources make it an important choice for traders for are looking for a viable DMA trading offer.

The commission for trading US stocks are $0, while over-the-counter stocks have a $6.95 commission (which could go down to $4.95 if a client executes at least 30 trades per quarter). When it comes to options, the cost is $0.65 per contract, while for ETFs and mutual funds the short-term trading fee is between $15.99 and $19.99. If you want to check the complete list of fees and commissions, make sure to check the E*Trade official website.

Pros and Cons

- A company with 36 years of experience in the online trading world.

- A wide variety of trading instruments to choose from.

- Low commissions for US-based stocks and for active traders.

- Some reviews suggest the account verification is slow.

- High commissions on over-the-counter assets.

- Mainly focused on the US market.

Summary

We can conclude that E*Trade is one of the most reliable options when it comes to DMA trading, especially for traders based in the US. Although the company has $0 commissions for US-based assets, it still has some disadvantages when it comes to over-the-counter assets, an inconvenience for those who want to diversify their exposure.

E*Trade Review

Product Name: E*Trade

Product Description: E*Trade is a financial services company offering online brokerage services to its customers at an affordable price. Founded in 1982, it is one of the better known and popular online investment brokers. They were responsible for executing the first electronic trade by an individual investor back in 1983 and ever since their reputation had continued to grow exponentially. With 30 branches in the US, E*Trade offers two trading platforms, a mobile app, 24/7 phone support, online chatting, email support and coverage for a wide range of products (stocks, bonds, mutual funds, ETFs, options, and futures).

Brand: E*Trade

Offer price: 100$

Currency: USD / EUR / GBP

Offer URL: https://us.etrade.com/home

-

Trading Platform

-

Langueges

-

Spread

-

Support

Summary

We can conclude that E*Trade is one of the most reliable options when it comes to DMA trading, especially for traders based in the US. Although the company has $0 commissions for US-based assets, it still has some disadvantages when it comes to over-the-counter assets, an inconvenience for those who want to diversify their exposure.