Introduction

First launched back in 2005 and originally known as TradeKing until mid-2016, Ally Invest is a US-based broker, with headquarters in Fort Lauderdale, Florida. Although it’s not as popular as other Wall Street names, it provides several important trading features, like $0 account minimum and $0 trading commissions for a series of trading instruments. Ally Invest is known as one of the “best low-cost brokers”, which is why we’ve decided to include it among the other companies already reviewed on our website.

Platforms

Ally Invest relies on a web-based platform that enables access to stocks, bonds, mutual funds, ETFs, options, and forex instruments. It offers quick trading capabilities, real-time streaming quotes, and data, as well as a customizable dashboard. Although there are no other platform options, customers who choose this company are able to trade from any kind of device since there’s no required installation.

We must also highlight that Ally Invest is focused on other services, not just trading. That includes home loans, online savings, and others. Since there is fierce competition in the industry, it would have been a strong point if the company had at least a desktop platform, alongside the web-based solution.

DMA Trading

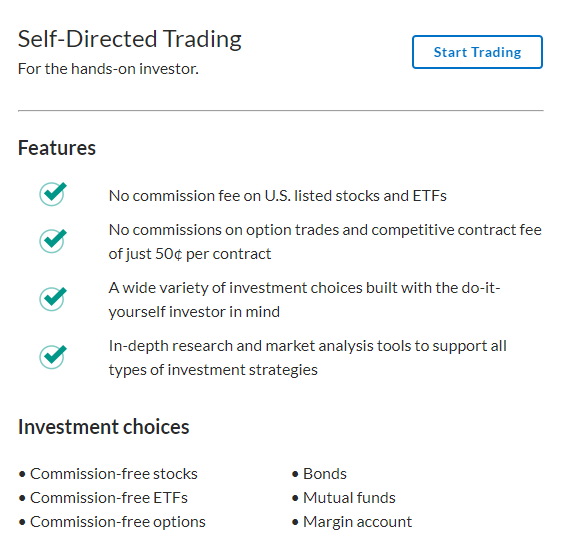

The services provided by Ally Invest are best-suited for active traders, options traders, forex traders, and commission-free trades. All ETFs are currently commission-free and for option trades, clients need to pay between $0 and $0.5 commission per contract. Like some other prominent industry figures, Ally Invest also offers $0 commission stock trading and there’s no account minimum in order to get started.

On top of this, the company is offering a suite of investing tools that exceed expectations for a broker with deep discounts. There are a few options trading tools (options pricing calculator, strategy scanner) and some free tools for technical traders powered by Recognia. Among other tools, we should mention the profit-and-loss calculator, a probability calculator, and the Maxit Tax Manager (which identifies tax implications of trading decisions).

We must mention some negative points, also. Ally Invest falls short when it comes to mutual funds. At the moment, the company offers access to more than 8,000 mutual funds, none of which is free of transaction fees. For no-load funds, the commission is $9.95, slightly higher as compared to other leading industry figures.

Summary

Ally Invest offers access to more-than-decent trading services, especially for traders who are looking to trade commission-free stocks, options, and ETFs. There’s only one web-based platform compatible with any device, and the company comes with interesting research and trading tools. We can conclude that this is a reliable company, but, as mentioned in the other reviews, their offer will not be suitable for all traders.

Ally Invest Review

Product Name: Ally Invest

Product Description: First launched back in 2005 and originally known as TradeKing until mid-2016, Ally Invest is a US-based broker, with headquarters in Fort Lauderdale, Florida. Although it’s not as popular as other Wall Street names, it provides several important trading features, like $0 account minimum and $0 trading commissions for a series of trading instruments. Ally Invest is known as one of the “best low-cost brokers”, which is why we’ve decided to include it among the other companies already reviewed on our website.

Brand: Ally Invest

Offer price: 100$

Currency: USD / EUR / GBP

Offer URL: https://www.ally.com/invest/

-

Trading Platform

-

Languages

-

Spread

-

Support

Summary

Ally Invest offers access to more-than-decent trading services, especially for traders who are looking to trade commission-free stocks, options, and ETFs. There’s only one web-based platform compatible with any device, and the company comes with interesting research and trading tools. We can conclude that this is a reliable company, but, as mentioned in the other reviews, their offer will not be suitable for all traders.

Pros

- Access to commission-free stocks, options, and ETFs.

- No account minimum and no inactivity fee.

- Robust offers when it comes to research and trading tools.

Cons

- There is no commission-free mutual fund.

- The company has no physical branches.

- Not as many trading instruments as other leading brokers.